Competitive Advantage

Central Location on US East Coast

- Midway between Washington DC and Atlanta, Miami and New York

Second Largest Regional Interstate highway system in the nation

- Interstates 73, 74, 85 and Future 685 in Randolph County, and nearby connections with Interstate 40, Interstate 77, and Interstate 95

- Half of U.S. population and most major markets within 700 miles

Right to work state

- Randolph County unionization rate less than 1%

Regional labor pool

- 45-mile radius labor pool of 1,094,641 workers

Workforce training

- Free customized worker training provided by Randolph Community College

- Degree and certificate programs available at Randolph Community College

- Apprenticeship Randolph youth apprenticeship program

- RandolphWorks youth internship program

- Pathways to Prosperity career training collaboration between schools systems and Randolph Community College

Utility reliability & cost ranked among best in US

- Excellent electrical, natural gas, water & wastewater availability

Rail served sites available

- Excellent industrial sites with all utilities available

Property taxes 22nd lowest in NC

- Randolph County is proud to rank 22nd lowest out of 100 North Carolina counties

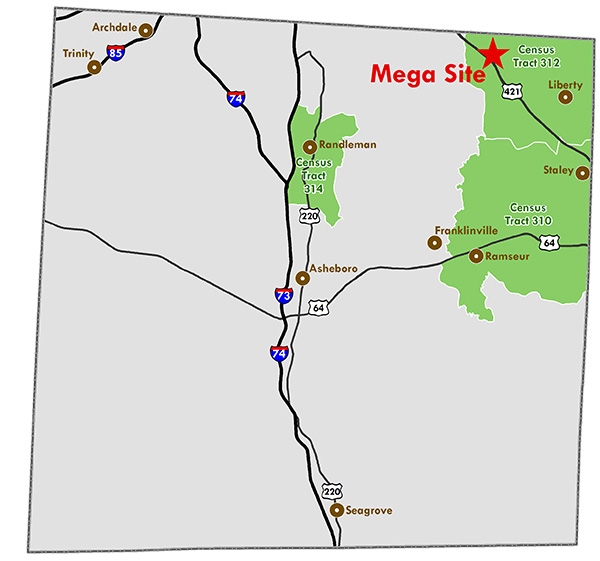

Opportunity Zones

The Tax Cuts and Jobs Act of the United States was signed into law on December 22, 2017 and includes the creation of Opportunity Zones. Randolph County has three Opportunity Zones, including the location of the Greensboro-Randolph Megasite.

The Opportunity Zones Program in Randolph County provides tax incentives for qualified investors to re-invest unrealized capital gains into low-income communities throughout the state, and across the country. Investments made by qualified entities known as Opportunity Funds into certified Opportunity Zones will receive three key federal tax incentives to encourage investment in low-income communities including:

- Temporary tax deferral for capital gains reinvested in an Opportunity Fund

- Step-up in basis for capital gains reinvested in an Opportunity Fund

- Permanent exclusion from taxable income of long-term capital gains

For more information about Opportunity Zones please visit the North Carolina Department of Commerce website.